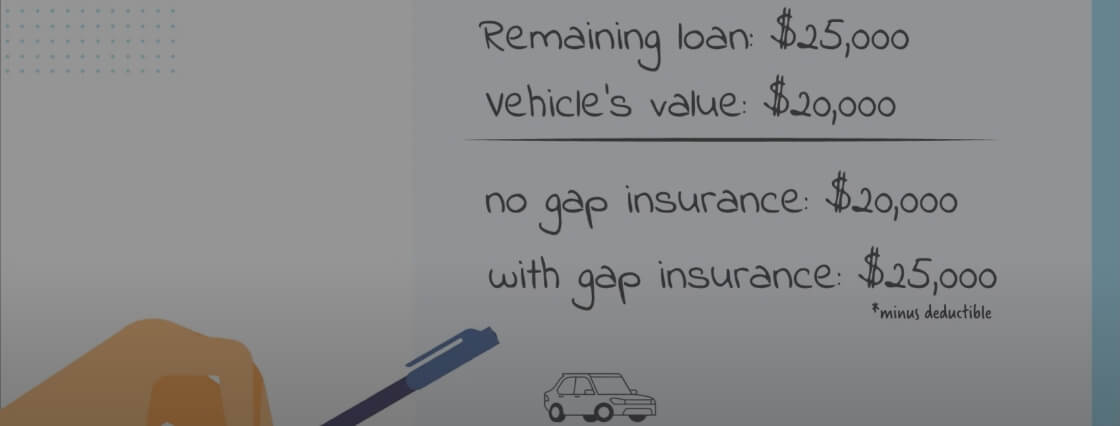

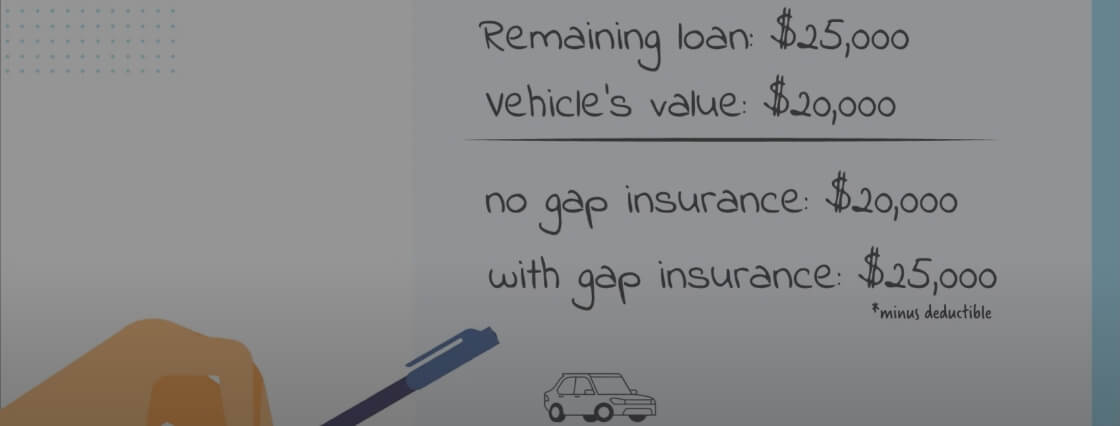

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

4 min to readExplore Progressive Answers' auto editorial guidelines to find out why you can trust the car insurance information you find here.

Gap insurance protects you from depreciation. Once you buy your car, its value starts to decrease—sometimes significantly. If you finance or lease a vehicle, this depreciation leaves a gap between what you owe and the car's value. Let's look at an example with gap insurance and without:

Example:You finance $30,000 for a new car. You've had it for a few years and have been making all your payments. It's now worth $20,000 but you owe $25,000 on your loan, representing a $5,000 gap. If the vehicle is totaled, your insurer would pay you $25,000 (minus your deductible). Without gap insurance, you'd only receive $20,000 (minus your deductible).

Keep in mind, to qualify for gap insurance, you must have comprehensive and collision coverage on your policy. Watch our quick guide to learn more details about gap insurance:

Progressive offers loan/lease payoff coverage, which is similar to gap coverage. The main difference is that the payout for Progressive's loan/lease payoff coverage is limited to no more than 25% of your vehicle's value, though the exact limit varies by state.

Gap insurance applies any time your vehicle is stolen or totaled in an accident. When you file a qualifying claim, your comprehensive or collision coverage will pay the actual cash value (ACV) of your vehicle, minus your deductible. Your gap coverage may then pay the difference between your vehicle's ACV and the outstanding balance of your loan or lease. If your gap coverage includes a limit, it may only cover a portion of your outstanding balance if you owe a lot more on the vehicle than it's worth. Note that gap coverage may not cover additional charges related to your loan, such as finance or excess mileage charges.

Keep in mind that gap insurance doesn't cover other property or injuries as the result of an accident, nor does it cover engine failure or other repairs

Play Video Answers | Gap Insurance

Gap insurance coverage bridges the gap between what you owe on your car loan and what your car is actually worth.

Copyright [2015 - 2021] Progressive Casualty Ins. Co. All Rights Reserved.

How does gap insurance coverage work?

Gap insurance coverage bridges the gap between what you owe on your car loan and what your car is actually worth.

Total loss of vehicle. Stolen vehicle not recovered.

If your vehicle is declared a total loss or it's stolen and not recovered, gap coverage works this way.

Amount covered by comprehensive and collision. Balance covered by gap insurance.

It may cover the difference between the amount paid out by your comprehensive or collision coverage and the balance left over on your vehicle loan or lease.

Remaining loan: $25,000

Vehicle's value: $20,000

No gap insurance: $20,000

With gap insurance: $25,000 *minus deductible

For example, if you owe twenty-five thousand dollars on your loan and your car is only worth twenty thousand, without gap insurance you'd receive a twenty thousand dollar payout. But with gap insurance you'd receive the extra five thousand needed to pay off your loan.

When to consider gap insurance.

So is gap insurance worth it? Gap insurance might be a good option to consider in these cases.

Significant difference between value and amount owed. Leasing your car. Smaller down payment on a new car. Longer financing term.

If there's a significant difference between your car's actual value and what you still owe on it. If you're leasing your car. If you made a smaller down payment on a new car or if you have a longer financing term. And even though gap insurance is optional some lenders and leasing companies may require you to purchase it.

Loan/lease payoff. 25%. *Exact limits vary by state.

Progressive offers loan or lease payoff coverage which is like gap insurance. The main difference is that the loan or lease payoff coverage is limited to no more than 25 percent of your vehicle's value.

Loan/lease payoff + Comprehensive + Collision.

Before you can add loan or lease payoff coverage, your policy must include both comprehensive and collision coverage. Once your car is paid off make sure you drop your loan or lease payoff coverage.

Let's discuss if loan/lease payoff coverage is right for you! We offer insurance by phone, online, and through independent agents. Prices vary based on how you buy.

Contact Progressive today to see if loan or lease payoff coverage is right for you.

When there's a significant difference between your car's value and what you owe on it, gap coverage can be a valuable safeguard. Consider buying gap insurance in these instances:

You're leasing your car: Lenders may require gap coverage on leased vehicles.You made a lower down payment on a new car: If your down payment is less than 20% of the sale price, you could end up with negative equity on the vehicle as soon as you drive away from the dealership. Do the math on this even if you're buying used — gap insurance for used cars can protect you from negative equity just like it does for new cars.

You have a longer financing term for your vehicle: The longer your vehicle is financed, the higher your chance of owing more on the vehicle than it's worth.

You want to protect yourself against depreciation: Some cars have a higher depreciation rate than others, so calculating the average depreciation for your car could help you determine if you need gap coverage.

You have a loan rollover: If you owe more on your loan than your car is worth at the time of renewal, gap insurance can help protect you against the negative equity.

Gap insurance isn't required by any insurer or state, but some leasing companies may require you to purchase it. Also, when purchasing a new car, some dealerships may automatically add gap insurance to your loan — however, you can decline this coverage. Check your current car insurance policy and car lease or sale documents to find out if you have gap insurance.

The cost for gap coverage varies by insurer. You can get an exact price for loan/lease payoff coverage, which is similar to gap coverage, from Progressive. Simply get a car insurance quote online and we'll give you an answer in minutes.

Once you add gap insurance, it applies for the duration of your policy. However, you won't need gap coverage for the entire length of the loan. Once you owe less than what the car is worth, you can drop the insurance.

While some dealers offer gap insurance for both leased and financed cars, you may end up paying interest on your gap coverage due to the bundled lease/loan payment. Buying gap insurance through your auto insurer can be a smarter option.

Answer some easy questions and choose coverages.

A licensed representative will answer any questions you have.

Need local advice? We'll connect you with a licensed independent agent near you.

Looking for more information about auto insurance? Our car insurance resource center has you covered.

Quote car insurance online or give us a call

Learn more about car insurance policies.

Please note: The above is meant as general information to help you understand the different aspects of insurance. Read our editorial standards for Answers content. This information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Descriptions of all coverages and other features are necessarily brief; in order to fully understand the coverages and other features of a specific insurance policy, we encourage you to read the applicable policy and/or speak to an insurance representative. Coverages and other features vary between insurers, vary by state, and are not available in all states. Whether an accident or other loss is covered is subject to the terms and conditions of the actual insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. We are not responsible for the content of any third-party sites linked from this page.

THE #1 INSURANCE WEBSITE

Copyright 1995 - 2024. Progressive Casualty Insurance Company. All Rights Reserved.

We offer insurance by phone, online and through independent agents. Prices vary based on how you buy.

Δ Discount varies and is not available in all states or situations.

Insurance carrier website ranking by Keynova Group – Q4 2023 Online Insurance Scorecard.